Market Guide

I predicted market correction on 8th June 2018(https://mycapitalchoice.blogspot.com/2019/07/my-chart-analysis.html) when NIFTY around 11850 and giving target of 11200 to 11100 (650 point correction). Which went more deep to 10850 as result of US Fed news came on 31 July.

Retail investors are currently worrying about erosion of their wealth. They are confuse what to do now. Going for fresh Buy? is question for all.

Buy at low and Sell at high

This is golden rule of market. There was a time when NIFTY touched his all time high to book profit and wait for correction.

From last 2-3 year small cap and mid caps gave negative returns then since last 14 to 18 months investors put their wealth in large cap. Large cap are part of NIFTY 50. so index was rising day by day that time. All money flow towards large cap from small and mid cap. Market was finding reason for correction since Feb 2019.

FPI(Foreign Portfolio Investors) Surcharge decision in Union Budget session became reason and market collapsed by 1000 to 1100 point since Budget Session. US Fed decision becomes oil in fire. FII sell their 1/5th Stake in July 2019.

On 1st and 2nd August 2019 Foreign Investors have withdrawn 2,881 Crore from Indian capital market.

What to do as Retail Investor?

1. Market may give more correction specially in Large cap. As large cap down Small and Mid also give more correction.

2. Wait for market consolidation of 3 to 4 days. (Base formation) Because market breaks most support so before going to uptrend need to be form support.

3. Small caps & Mid Caps available at attractive price. Choose only those who fundamentally strong.

4. Many Stocks are going through temporary issues keep eye on that and grab when issues will resolve.

5. Stay away from Automobile sector, NBFC's, Steel companies.

6. Give preference to FMCG, Power and Tech companies.

7. Be patient.

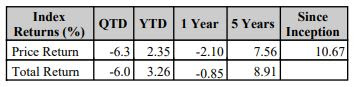

Below are details of Returns of Indices

A. Nifty 50

B. Nifty Mid cap 50

C. Nifty small cap 50

Points keep in mind while investing

- The Rise of India’s Young Consumers.

- Improving education, improving technology and connectivity – that’s going to unleash a lot of spending power in the coming decades.

- The spending power of a young, connected Urban Mass.

- Mobile connectivity and E-commerce.

Mayur Jagtap

Investment Consultant

For regular and daily small update

Join Telegram- https://t.me/mycapitalchoice

Join on Facebook- https://m.facebook.com/mycapitalchoice

Comments

Post a Comment